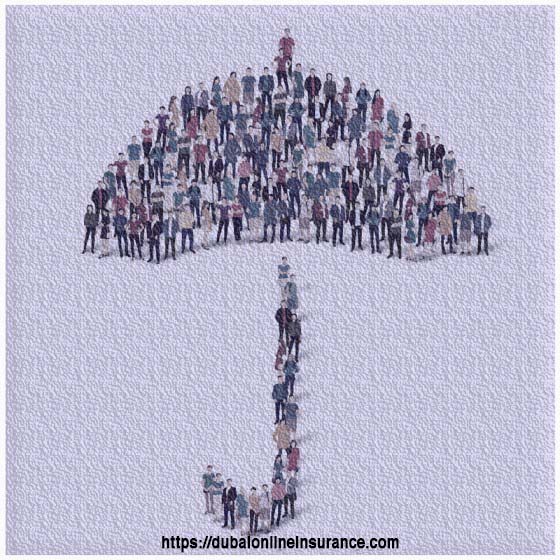

WHAT IS GROUP LIFE INSURANCE ?

Group life insurance is a kind of insurance in which the company/employer secures its employees, workers or an entire group of members. Moreover, organizations that invest in their members result in bigger and better returns. After all, they are your most valuable treasure, helping you grow.

In Group life insurance, the policy holder is an employee or worker in the organization, such as a business organization and the insurance covers the members of the Organization.

HOW GROUP LIFE INSURANCE WORKS ?

Group life insurance is often offered by an organization to its workers or members. It covers any accident while on the job or during the working hours. Natural death is also covered in this policy.

For example , if a workers hand gets injured while operating machinery or a management staff member falls on the stair of his/her office, these accidents and other related accidents are all covered under this policy. Sum Insured is the main factor in this insurance.

There are 3 categories in any office. The workers/labor, the office staff/administrative staff and the management.

The higher the amount of risk involved, the higher sum insured should be kept. For example, a worker/labor is more prone to accidents than anyone sitting in an office environment. However, it all depends on the employer/organization what they want. A list of all members of the organization is required with their sum insured decided by the organization. A very competitive rate is given by Dubai Online Insurance which is much lower than if they were to purchase an individual policy.

All the members do not receive their Insurance Certificates, only one certificate is issued to the organization with all member names which are covered in the policy and there sum insured as this is a cover from the organization to its employees to secure the company from any liability towards there employees. Group life is the exact solution to protect your workforce and their families in case of death, critical conditions, accidents or disabilities.

CONDITIONS FOR GLI Policy

Conditions From an Organization

Group life insurance for an organization usually come with few conditions. Some organizations or Associations require group members to participate for a fixed amount of time before they are granted coverage i.e a member may need to pass a threshold period before being benefited from Group Insurance policies.

Conditions from GLI provider

Coverage is only valid for the member who is part of the organization. For example, a member is covered for as long as he remains with his company. GLI coverage remains active until your membership is terminated or until the limited term of coverage ends.

KEY ADVANTAGES OF GROUP LIFE INSURANCE ?

The biggest benefit of group life insurance for an organization or its members is its value for money. Generally, the employer pays for the policy and nothing is charged by the employees. However Group members pay very little in case if they are told to do so by there organization. Insured parties should weigh out the benefits with low cost and convenience. Unlike individual life insurance, GLI policy do not require medical certifications.

Allows higher risk individuals to be given life insurance coverage.

When offered as part of a basic benefits package, the coverage is often free to the employee, with higher levels of coverage available at group life insurance coverage rates.

In the GL insurance, Policyholder and the members of the organization bears many benefits like

- Death due to any cause.

- Medical expenses due to accident.

- Repatriation expenses.

- Permanent total disability.

- Partial disability.

HOW GLI IS LIMITED ?

Beyond Limitless advantages, their are few disadvantages for the members as listed below.

The coverage ends when you leave the company. Your next employer might not offer the benefit. Your GL insurance benefits can also end if the employer decides to terminate the policy to cut costs.

Group life insurance insures only basic coverage, thus another limitation for the member to be benefited. Generally, the death benefit is one or two times your annual salary. The member is dependent on the organization in someway. Healthier individuals pay the same premium amounts as those who are considered to be a higher risk within the organization policy. Mostly, people need extra coverage to adjust for coverage excluded in their company’s GL insurance.

WE SERVE OUR CUSTOMERS WITH OUR TOPMOST GROUP INSURANCE POLICIES ……

Yes at Dubai Online Insurance, you can enjoy with our group insurance policies.

Why organizations like us ?

Our clients from different organizations and associations are enjoying from our best GL insurance services and our quality response.

How can one establish contact with Dubai Online Insurance and enjoy our Group Life Insurance Services.

We as an Insurance (Tameen) specialist, specialize in the following areas :

- Property All Risk Ins. / Fire Ins.

- Travel Insurance.

- Marine (SEA/AIR/ROAD).

- Motor Ins / Vehicle Ins / Car Insurance

- Group Life Insurance

- Building Insurance and Landlord Insurance

- Workmen’s Compensation Ins.

- Contractor’s All Risk Ins.

- Professional Indemnity Ins.

- Health Insurance Dubai

- Third Party Liability Ins.

- House Holder’s Ins.

- Jeweler’s Block.

- Contact Us To Know More….

Contact Us:

Address: Al Khalidia St – Sharjah

Email : info@dubaionlineinsurance.com