Workmens Compensation Insurance In Dubai

Workmens Compensation Insurance in dubai (Tameen) and other parts of the emirate is a must. As UAE has best Laws to protect the rights of its Citizens and Residents. Workmen compensation insurance is necessary. The Ministry of Labour Law in UAE states – Anyone injured while doing any job related activity in working hours is the responsibility of the Employer, as he is the one who is responsible for the safety of his employees. In the event, the employee gets injured, his employer has to entertain all the expenses. This is when Workmen’s Compensation Insurance in dubai comes into play and handles the financial aspect. The insured gets treatment from the Hospital/Clinic and collects the receipt after payment. The insured aligns the receipts and other related documents to the insurance provider. And then the reimbursement procedure begins.

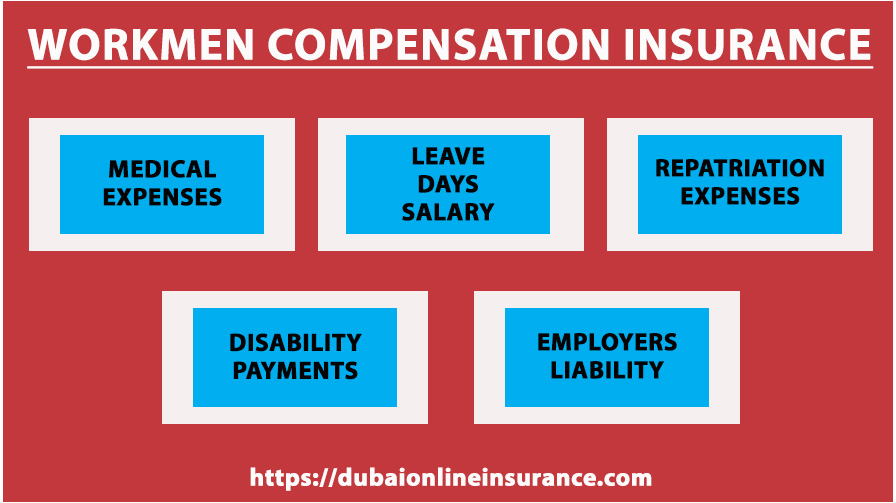

Workers Insurance Covers :

Moreover, Dubai Online Insurance as a service provider offers best Workmens Compensation Insurance In Dubai at the very best rates. The main benefits of Workmen’s Compensation are as described as under :

- Work Related Injury.

- Permanent Total Disability.

- Permanent Partal Disability.

- Temporary Disability.

- Medical expenses will be covered up to a given limit.

- Repatriation Expenses are covered.

- Employer’s Liability covered upto AED 1,000,000/- in the aggregate – with a sub-limit of 200,000/- per employee within the overall limit.

- Medical leave days salary is also covered.

The construction sector needs to have Workmen’s compensation insurance (Tameen) in place even before working on any project. As it is a compulsory precautionary step. The workers and the management feels safe and secure if any accident takes place. As a working (construction) site is a potential risk for all the workers and other staff around them. In the event of death, while working on a project because of an accident, blood money, based on Sharia Law is provided to the insured’s beneficiary.

Why Workers compensation insurance is required ?

All states of UAE are law abiding states and it does not tolerate any kind of mistreatment to its citizens and residents. If you are an employer and you are thinking that after a considerable harm or injury to an employee while working, you can save yourself from the law then maybe you’re wrong.

However, workers insurance is necessary before the start of any project. Whether it be building construction, maintenance, labour supply, etc. Without this insurance policy no work can be allowed by the main contractor. As they have to keep the workers and their site secure from any mishaps.

There is no such thing as forgiveness in this matter. So it is important for all the Businessman and employers to have workers insurance in Sharjah.

How Workmen compensation protects the employers?

If something happens to an employee under the care of an employer then it is considered the fault or negligence of an employer.

It doesn’t matter if the employer is involved in the negligence or not. In case something happens to an employee then the employer will be held accountable as it is his responsibility to provide safety to his employees.

As we have already discussed that Sharjah and its member states all are law abiding and it does not tolerate any kind of mistreatment. In such a scenario it is important that an employer have something which defends him and workmen compensation exist for this very purpose.

When an employer buys this insurance then no one can hold him accountable because through this insurance policy the employer can pay a compensation to the employee to save himself from any legal trouble. This insurance policy is a give and take policy. The employer pays for the medical expenses of the employee in case of injury while working and then the insurance company reimburses the company.

The procedure is simple. As soon as the injury occurs, accident intimation form will be filled by the employer and send to the insurance company for accident notification. After the treatment is completed the employer will submit all the original expense bills to the insurance company. And then the insurance organization will reimburse the expense after reviewing the documents.

Workmen compensation insurance policy exist for the benefit of an employer and employee. There is no reason why an employer should not buy this policy right away.

Workmen Compensation insurance saves the employer against financial loss

Financial loss is a dangerous thing. When a person is facing tough times financially then his whole reputation is on stake.

It is very important for an employer to secure his reputation because it is by dint of his reputation that he gets assignments and projects in his field. Workmen compensation insurance makes sure that the employer is safe against any losses.

Even if an employee gets injured in the premises of an employer due to an accident then the insurance company covers the compensation.

This policy is a mentor in disguise and the employers of all businesses should buy this insurance policy as soon as possible.

We at Dubai Online insurance can help you. We make sure that we get you the best policy. As, we have professionals which have been devising the workmen compensation insurance policies for so many years. Our staff will secure you the best deal. And make sure that you are saved against third person in economical ways.

An employee is entitled to what benefits with Workmen compensation insurance?

Workmen compensation insurance is an amazing insurance policy through which an employee is safe in case any accidents which occurs while working.

God Forbid if something happens to an employee on the job or duty then it is secured by the insurance policy.

If any accident happens then the employer or any other person goes with the employee to the hospital and on return shows the receipts to the employer and the employer forwards it to the insurance company. Workmen insurance is a best policy for employers and by buying this policy one can save himself from any financial loss. For instance if the employer does not have this policy with him then in case of injury or death of the employee all the expenses are to be owned by the employer.

Get in touch with Dubai Online Insurance and secure yourself the best workmen Insurance policy.

Benefits of Workmen Compensation Insurance

- It is the best insurance policy for employers and employees.

- With the help of this insurance an employer can save himself against liability.

- This policy covers medical expense upto AED 10,000/- to 35,000/-.

- It is specifically the best policy for contractors because construction work is dangerous and anything can happen to an employee on a construction site.

- In case of death of an employee, blood money according to Sharia Law is given by the insurance company.

- With the help of this policy employees can also make sure that their rights are saved and that they are protected.

How Workmen’s Compensation Insurance can be issued ?

However, this policy can be easily issued with very few requirements, and mostly within the same day. The above are the few requirements to issue the insurance policy.

- Trade License.

- Vat Certificate / TRN Certificate

- Employees List with details. Name, Designation and Salary.

| S.No | Name | Designation/Job Description | Monthly Salary |

| 1 | Mathew | Painter | 1500 |

| 2 | Albert | Window Cleaner | 1200 |

| 3 | Kashif | Tiles Fitter | 1000 |

| 4 | Faris | Mason | 1200 |

| 5 | Ahmad | Tile Cutter | 1200 |

| 6 | Haris | Carpenter | 1500 |

| 7 | Mohd. Abdullah | Electrician | 1500 |

| 8 | Ali | Block Fixer | 1500 |

| 9 | Rami | Foreman | 1800 |

Surprisingly, the quote can be issued within few minutes after these details are provided.

Workmen Compensation Insurance UAE Law

You can read the Labour Law published by the UAE Ministry Of Labour as under :

Article 142

Might need to the personnel structure the work-related harm or even ailments detailed within Alternatives 1 and 2 housed herewith [press finest suitable within to really have the total arranged of your personal injury and ailments], the organization enterprise, enterprise business good or even the agent thereof shall notify the function promptly to the regulators likewise to the task Group or only an important section thereof within whose jurisdiction the function inhaling breathing breathing space could become present at a distance.These warning announcement shall add the phrase, era, occupation, nationality and address of the worker, an instances and synopsis of the incident and the authorized help or treatment provided.

Upon the invoice of the notification, the authorities shall execute the mandatory data and investigations in and take occasions of the assertions of the witnesses. The ongoing company organization industry organization organization besides the consultant thereof, and the injured, should his display so allows. Significant misconduct of the employees arise these types of occurrences plainly generally occupational specifically, organized, or s from .

These kinds of occurrences shall create the belief that would presumably be usual activity specifically, organized, or arises from the important misconduct of the staff.

Article 143

Upon the completion of the investigations. Law enforcement shall send a copy of the minutes to the Labour Department and another to the organization.

Article 144

In cases of work-related injuries or diseases, the employer shall undertake to keep the considerable cost consistently in treating the worker in a governmental or person community therapeutic center until his recovery or accepted disabled. This type of approach shall entail beliefs of hospitalization or stay at a sanatorium, substantial specialist good care, by – UV rays and very worthwhile examen, treatment meds, and rehab unit. And the challenge in an arrangement that it usually is simple to safe and sound created limbs and a large amount of most prosthetic gizmo when inability is often obviously started up. The commotion therapeutic difficulties shall fork out for the inspiring talk to for on any consider inquired excellent proper care of the office workers/customers.

Article 145

Should the personal injury prevent the employee from executing his work. The company shall pay him an allowance that is add up to a full income for the whole amount of treatment, or for an interval of half a year, whichever is shorter. If the length previous for more than half a year. The allowance will be reduced by 1 / 2 and such for the next half a year or before the employee completely recovers is announced handicapped or dies, whichever occurs first.

Article 146

The allowance described in this Article will be calculated based on the last wage anticipated to regular, weekly, daily and hourly-paid workers. And also based on the average daily wage established in Article 57 hereof for the personnel getting paid by piece.

Article 147

Upon the finish of the procedure, the treating doctor shall set a written report in two copies. One sent to the staff member and the other to the work place. Such article shall be the type, cause, timeframe of occurrence of the mishap, and total amount to which such accident is work related and the length of time of treatment from there. Whether it resulted in everlasting or other impairment, the quantity of impairment, if any, be it total or imperfect. The total amount compared to that your disabled staff member is with the capacity of resuming work regardless of the impairment.

Article 148

For instance, if a dispute comes up based on the fitness of the employee for service or the amount of impairment or any other concerns related to the personal injury or the procedure, such matters will be described by the Ministry of Health via the competent Labour Section. In fact The Ministry of Health, after the receipt of such a dispute, shall form a medical committee of three federal government physicians to look for the fitness of the employee for service, the amount of impairment or any other subject related to the personal injury or treatment.The committee may request the help of any experts. The Committee will respond accordingly to your choice.

Article 149

In case the occupational harm or disease cause the fatality of a worker, the family thereof will be eligible for reimbursement add up to the fundamental income of the employee for two years, as long as the amount of reimbursement extends to minimal eighteen thousand Dirhams or higher than 35 thousand Dirhams. The amount of reimbursement will be calculated based on the earnings. The reimbursement will be discharged one of the beneficiaries of the deceased workers relative to the measures of this program enclosed herewith.Within the execution of the sorts of processes of the Article, the appearances’ the strap of the deceased employee’ shall signify those who totally or mainly rely with respect to subsistence of the wage of the deceased worker during his fatality.

Examples of such individuals will be:

a – The widow(s).

b – The kids, namely:

1 – Sons under 17 years, under 24 years regularly enrolled in academic institutions, and sons who are mentally or physically incapacitated in this extent they can be actually attempting to earn their own living. The word “sons” shall will be the sons of the spouse or the spouse reliant on the deceased worker during his loss of life.

2 – Unmarried daughters including also unmarried daughters of the spouse or the spouse reliant on the deceased worker during his death.

c – The parents.

d – The siblings in accordance with the conditions collection for the sons and daughters.

Article 150

The worker will be qualified to get compensation relative to the rates occur the schedules enclosed herewith, also multiplied by the worth of the loss of life compensation in the event the occupational harm or disease partially disable the worker in an prolonged long-term manner.

Article 151

The number of compensation will add up to the quantity due in case there is his death.

Article 152

Whenever necessary, and with the consent of the Minister of Health, the Minister of Labour may amend the schedule no. 1 on the occupational diseases, and routine no. 2 on the impairment settlement research enclosed herewith.

Article 153

The injured worker will not get a compensation in case of harm or handicap not resulting in death. Further, if it is revealed in the investigations of the competent authorities that the employee has hurt himself intentionally. Similarly, Intention of committing suicide or of finding a settlement, a sick certificate or elsewhere. If the worker be in the time of the episode swallowing alcohols or medications, in case the worker breach the safety directions posted in prominent places at the work intentionally, if his handicap or harm are based on a gross and willful misconduct on his part; or if he refuse for no substantial cause to endure medical examination or treatment bought by a health committee shaped in pursuance to the provisions of Content substance 148.

Moreover, Treating the employee or paying out any allowance thereto in such instances is not company’s responsibility.

Disclaimer : The following text is from the UAE Ministry of Labour’s Legislation. If there is some error in this text writing kindly ignore and go to the recognized MOL (Ministry Of Labour) website. Thank You.

Our Services

Our professional services are without a doubt the best in the industry. We also provide full guidance for workmen compensation insurance. And explain each policy benefit to the customer before they buy our services. Similarly, Dubai Online Insurance offers workmens compensation insurance in dubai at lowest price.

We as an Insurance (Tameen) specialist, specialize in the following areas :

- Property All Risk Ins. / Fire Ins.

- Travel Insurance.

- Marine (SEA/AIR/ROAD).

- Motor Ins / Vehicle Ins / Car Insurance

- Building Insurance and Landlord Insurance

- Workmen’s Compensation Ins.

- Contractor’s All Risk Ins.

- Professional Indemnity Ins.

- Health Insurance Dubai

- Third Party Liability Ins.

- House Holder’s Ins.

- Jeweler’s Block.

- Contact Us To Know More….

Contact Us:

Address: Al Khalidia St – Sharjah

Email : info@dubaionlineinsurance.com

Map

Call Us For Details At : 050 717 9800